By Bradley S. Buttermore

Managing Director and Chief Financial Officer

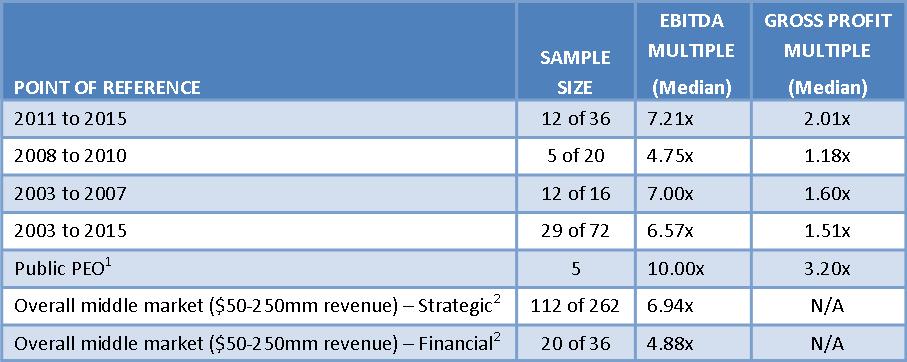

PEO valuations are currently very high and have exceeded the aggressive levels experienced from 2003 to 2007. My belief is that industry multiples will stay strong for the near-term as consolidation activity remains robust. The summary below is based, in part, on the observation of 72 PEO acquisitions or merger transactions from 2003 through 2015.

As is the case with private company transactions, the terms of most transactions are not published. I have obtained estimates from transactions that I participated in as an intermediary and also through sources I believe are trustworthy, but there is no guarantee that the price and terms components accumulated are accurate for each transaction. The data is broken into four time periods to provide some contrast of high-value and low-value market segments.

(1) ADP, TriNet, Insperity, BBSI & Paychex, as of 2/11/2016.

(2) For the twelve-month period ended 2/11/2016.

OPERATING METRICS AFFECTING DESIRABILITY AND VALUATION:

While it is convenient to have historical data for private company valuations, the data provides only an estimate of what average multiples look like at different periods in time for different organizations. The key to a successful valuation experience is finding a buyer who needs or desires the characteristics of your PEO. As might be expected, any service you provide that separates you from your competition in terms of quality or special services (safety training or health education services for example) usually serves to increase your multiple. The more risk you assume in your operation may increase your profits, but may negatively impact quality of earnings evaluations and, generally, have a limiting effect on your ability to obtain a high multiple.

The actual multiple that a willing seller may experience will be determined by many factors including, but not limited to:

- Geographic Market

- Client Industries

- Portfolio Risks for Health and Workers’ Compensation

- Size of the Client/WSE Base

Assuming a willing seller can locate a willing buyer based on the above, the following items will have the biggest impact on value that can be realized from the transaction:

- Having more than one offer available is critical when selling your business

- Organic sales growth

- Client retention

- Components gross margin (quality of earnings or revenue stream)

- Administrative fee levels that constitute a majority of gross profit

- Contribution from and method of processing SUTA

- How profits from workers’ compensation insurance, if any, are realized and recorded

- Size of the potential workers’ compensation premiums

- Strength and fit of your management team

Please contact me if you have any questions or would like to know more about our Human Capital Management merger and acquisition practice.